To this end, an e-Invoicing Business Expert Group was set up in 2017 on the initiative of the Federal Public Service Policy and Support (BOSA), The Agency for Facility Operations of the Flemish Government and the Federation of Belgian Enterprises (VBO)..This group's mission is to remove the obstacles facing e-invoicing in Belgium.

Its primary aim is to find, work out and share solutions for concrete implementation and business problems faced by companies looking to invoice electronically in Belgium. This concerns both electronic invoicing in a Business-to-Government (B2G) context and in a Business-to-Business (B2B) context.

In addition, the e-Invoicing Business Expert Group also wants to promote electronic invoicing in Belgium by raising awareness about the benefits of electronic invoicing.

The Business Expert Group brings together a diverse group of stakeholders (companies, governments, service providers, PEPPOL access points, sector federations, etc.). Together, these stakeholders have the necessary expertise to identify and analyse implementation problems, which are often related to typical Belgian business practices (accounting, financial, cross-sector, legal, VAT), and propose concrete solutions to said problems.

Although different e-invoicing standards exist, the e-Invoicing Business Expert Group focuses primarily on the European-recognised PEPPOL BIS format.

Belgian federal and regional authorities have been working for several years on the development of e-invoicing based on the European interoperability framework PEPPOL. For example, the Government of Flanders has required an electronic invoice for all its public contracts in accordance with European rules since the start of 2017. The federal government is also able to receive electronic invoices in most government services. The Brussels and Walloon public services are also preparing for this.

e-invoicing to the government according to the PEPPOL BIS format creates an opportunity for B2B e-invoicing. Although sectoral e-invoicing formats catering to specific sectoral environments have existed for a long time, today a universal cross-sector invoice format is lacking. As a result of the obligation to invoice the government electronically using the PEPPOL BIS format, many companies in various sectors will implement this format. This is an excellent opportunity to achieve greater interoperability in B2B as well, which will facilitate the transition to electronic invoicing.

In addition, since 17 April 2019, governments across Europe have been required to accept e-invoices that comply with the European e-invoicing standard (EN 16931). The new version PEPPOL BIS Billing 3.0 complies with this and is therefore a tool to meet this legal obligation.

And finally, PEPPOL is not only used in the EU. By mid-2019, PEPPOL was used in Canada, Singapore and the United States in addition to 32 European countries. Australia and New Zealand also switched to PEPPOL in late 2019.

In this context, scenarios based on PEPPOL BIS v3 are published on a regular basis, describing various scenarios in detail. The defined scenarios are:

- Minimal Invoice

- Consumer empties

- Conditional discount (cash discount)

- Standard exchange

- Invoice not EUR – VAT in EUR

- …

These scenarios contain references to various legal anchoring points (VAT code, Economic Law Code, Belgian Code of Companies and Associations, European VAT regulations, European Standard for e-Invoicing, etc.) and examples (technical and human-readable format).

e-Procurement

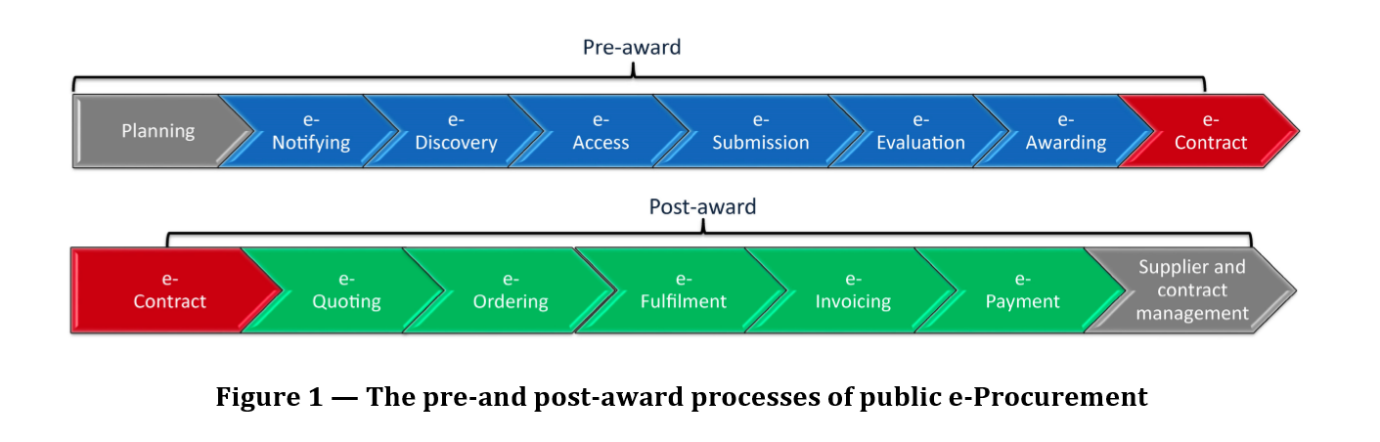

Electronic invoicing is not an end point in itself, but it is the end point of e-Procurement. In this context, many more messages are available, making the exchange of data increasingly machine-to-machine, whereby human intervention is unnecessary (and the risk of errors is therefore reduced).